In 2024, off-plan properties accounted for 63% of all Dubai real estate sales.

$255 billion worth of properties sold before they were built.

And the average investor buying off-plan paid

20% or more above secondary market prices for the exact same locations.

These aren't opinions. These are publicly available statistics that anyone can verify. Yet somehow, 63% of buyers still chose off-plan.

Why? Because the entire Dubai real estate ecosystem—developers, agents, brokerage firms—is designed to push off-plan. It's where the money is. Not for you. For them.

I'm writing this as an investor who owns nine properties in Dubai, all purchased in cash. My family has been investing in real estate for over 100 years. We hold multi-eight-figure portfolios across warehouses, land, commercial buildings, and residential properties in multiple countries.

I've also bought off-plan myself. Four units. It was a mistake I'm still dealing with. So when I call off-plan a scam, I'm speaking from direct experience—not theory.

Here's the data that proves it.

The Numbers Don't Lie: Off-Plan Premium Analysis

In 2018, comprehensive market research revealed the true cost of buying off-plan:

Off-plan buyers paid 1,319 AED per square foot.

Ready property buyers paid 911 AED per square foot.

That's a

45% premium for buying something that doesn't exist yet, in the same locations, from the same developers.

Think about that. You're paying 45% more for a brochure and a promise. For the privilege of waiting 2-4 years. For construction risk, handover delays, and a finished product that may not match the renders.

You can verify these numbers yourself. Search for Dubai off-plan vs secondary market price analysis. The data is public. It's been public for years. Yet 63% of buyers still choose off-plan.

The question is: why?

The Three Traps That Catch Investors

Trap #1: Inflated Launch Prices

When developers launch a new project, they don't price it at market value. They price it at what they can extract from buyers who don't know better.

The 45% premium isn't an accident. It's the business model.

Developers make their margin at launch. Agents make 5-7% commission. And buyers? They sit on depreciating assets for years, wondering why their "investment" isn't performing.

Real example: A friend bought a three-bedroom in Damac Paramount for 4 million AED. Current valuation: 2.8 million AED. That's 1.2 million AED in losses—$300,000+ USD—on a single unit. From a major developer. In a prime area.

This isn't investing. This is donating money to developers.

Trap #2: The Payment Plan Illusion

Developers make off-plan feel accessible: 10-20% down payment, installments during construction, balance on handover.

What they don't emphasize:

Many developers restrict resale until you've made full payment

If you can't make payments on time, you'll get court notices

If you need to sell before handover, you'll likely sell at a loss

Your capital is locked for 2-4 years with zero income

The payment plan makes you feel like you're getting a deal. In reality, you're locked into an overpriced asset with no exit.

Trap #3: The Commission Conflict

This is the real driver of the off-plan market.

Off-plan commission: 5-7%

Secondary market commission: 2%

Some developers are offering 10% commission to agents who sell their projects. Obviously agents push off-plan. The economics are overwhelming.

Imagine you're an agent. An investor walks in wanting to buy property in Dubai. You have two options:

Off-plan: Show a brochure, take them to a nice presentation room, collect 5-7% commission. Done in an afternoon.

Secondary market: Put in 200-500 offers to find undervalued deals, negotiate with motivated sellers, handle viewings and inspections, collect 2% commission. Weeks of work.

Which one do you think agents prefer?

The entire brokerage ecosystem is built to sell you off-plan. It's not a conspiracy—it's simple economics. And investors pay the price.

The Depreciation Data: Area-by-Area Breakdown

According to Bayut (one of Dubai's largest real estate aggregators), here are the year-over-year price declines from 2018-2019 for off-plan purchases:

Palm Jumeirah: -16.6%

Downtown Dubai (1-beds): -9.1%

Discovery Gardens: -15%

Business Bay: -5%

These aren't fringe areas. Palm Jumeirah is one of Dubai's most prestigious addresses. Downtown is the heart of the city. Yet off-plan buyers in these areas lost 5-17% of their capital in a single year.

Here's what happens: You buy a phone worth $1,000 for $1,200 because it's "new" and "exclusive." You flip it to someone else for $1,400 based on hype. They sell it for $1,600. Eventually, the market realizes the phone is worth $1,000. Everyone who's still holding takes the loss.

Off-plan is a game of musical chairs. The developers and early flippers make money. Long-term holders—real investors building wealth—get stuck with overpriced assets.

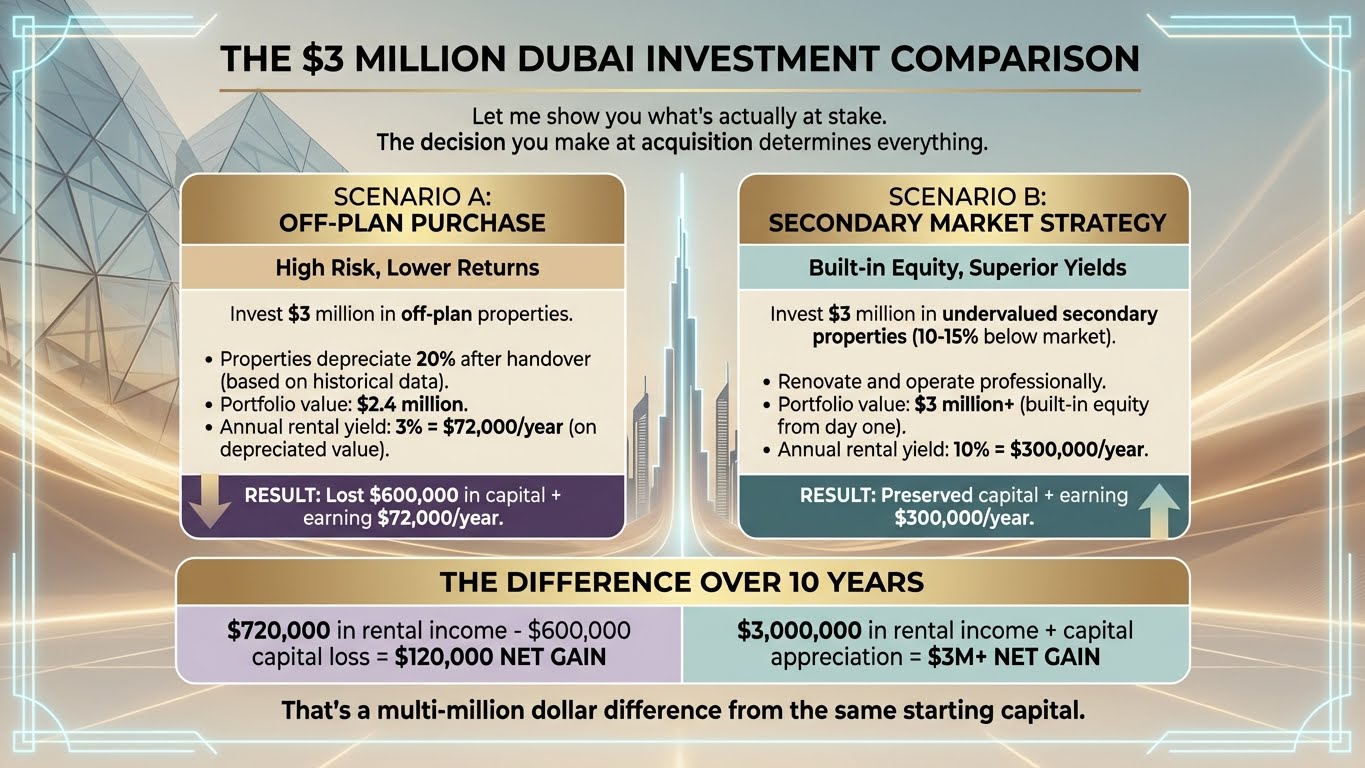

The $3 Million Comparison

Let me show you what's actually at stake.

Scenario A: Off-Plan Purchase

Invest $3 million in off-plan properties

Properties depreciate 20% after handover (based on historical data)

Portfolio value: $2.4 million

Annual rental yield: 3% = $72,000/year (on depreciated value)

Result: Lost $600,000 in capital + earning $72,000/year

Scenario B: Secondary Market Strategy

Invest $3 million in undervalued secondary properties (10-15% below market)

Renovate and operate professionally

Portfolio value: $3 million+ (built-in equity from day one)

Annual rental yield: 10% = $300,000/year

Result: Preserved capital + earning $300,000/year

The difference over 10 years:

Scenario A: $720,000 in rental income - $600,000 capital loss = $120,000 net gain

Scenario B: $3,000,000 in rental income + capital appreciation = $3M+ net gain

That's a multi-million dollar difference from the same starting capital. The decision you make at acquisition determines everything.

What Actually Works: The 6-Step Alternative

If off-plan is the problem, what's the solution?

Here's the exact strategy I use to achieve 10%+ net ROI on my Dubai properties—the ones doing 12% annually:

Step 1: Target Proven Areas Only

Focus on areas where demand is established, not projected:

JLT – Strong rental demand, metro access

Dubai Marina – Tourist demand, beach proximity

Business Bay – 60% commercial offices, professionals need housing

Downtown – Burj Khalifa, Dubai Mall, tourist epicenter

These areas have metro stations, commercial activity, tourist attractions. People

need to be there. You're never worried about finding tenants.

Step 2: Buy Older Towers at Discount

Here's the insight most investors miss: older towers (5-10 years) in prime areas trade 20-30% below comparable new towers. The depreciation has already happened. But the fundamentals—location, demand, infrastructure—haven't changed.

An agent once told me a tower was "too old" at 7 years. An agent who's never owned a single property. Never invested a single dirham of their own capital. Telling me what to buy.

Our family has bought plots that gave us 30x returns over 20 years. That's how you build wealth. Not by chasing shiny new towers.

Step 3: Source 10-15% Below Market

This is the hard part. You need to put out 200-500 offers to find motivated sellers willing to sell below market.

Why don't agents do this? Because it's work. They'd rather show you a brochure and collect 5-7%. But this is where the returns come from—buying correctly.

Work with agents who will put in volume offers directly to owners. Distressed sellers exist—visa issues, divorce, liquidity needs, estate sales. You just have to find them.

Step 4: Renovate to Premium Standard

Budget: 70,000-80,000 AED ($20,000-$22,000 USD)

What to do: new tiles, bathroom renovation, kitchen cabinets, proper furnishing.

Result: your unit becomes the best apartment in the building. Older tower, premium interior. Guests or tenants care about where they

live—inside the unit—not what the lobby looks like.

A properly renovated older unit will outperform fancy off-plan towers. Location + interior quality beats "new" every time.

Step 5: Operate with Blended Strategy

Peak season (November–April): Short-term rentals on Airbnb, Booking.com, VRBO. Capture maximum nightly rates when Dubai is packed with tourists.

Off-peak (May–October): Mid-term rentals (1-6 month contracts). Corporate relocations, project professionals. Stable income without peak-season turnover.

This is how you hit 10-12% net. Long-term rentals alone won't get you there. You need the blended approach.

Step 6: Refinance and Scale

Once you have documented rental income, Dubai banks will refinance 60-80% of property value.

$3 million portfolio → $1.8-$2.4 million in refinancing → buy more properties → repeat.

This is how portfolios scale without continuous capital injection. Cash-flowing properties fund their own growth.

Why I'm Telling You This

I bought four off-plan properties myself. Two and a half years ago, pre-launch. Handover is coming in a month. I've learned my lesson.

The properties generating 12% net ROI? All secondary market. All older towers. All renovated. All operated with the blended strategy.

The off-plan units? I might resell them and redeploy. Because holding off-plan long-term doesn't build wealth—it destroys it.

My family has been investing in real estate for over 100 years. We've never chased shiny objects. We buy, we hold, we never sell. That philosophy requires buying correctly in the first place.

Off-plan isn't buying correctly. The data proves it. My experience proves it. Don't make the same mistake.

CTA 1 will appear here