Everyone chases the shiny object in Dubai.

Agents will pitch you luxury projects in Palm Jumeirah. They'll show you renders of gleaming new towers. They'll tell you about "exclusive" developments with world-class amenities.

What they won't tell you: those "premium" properties generate 3% ROI.

Meanwhile, the properties that actually cash flow—8% to 12% net annually—are the ones nobody wants to show you. Older towers. Units that need work. Buildings that aren't Instagram-worthy.

I've bought nine properties in Dubai, all in cash. I come from a family that's been investing in real estate for 100 years with multi-eight-figure portfolios. And I've learned that the framework for evaluating properties matters more than any agent's pitch.

Here are the five criteria I use before buying any property—and the strategy that consistently delivers 8-12% net returns.

Why Most Investors Lose Money in Dubai

Before we get into the framework, you need to understand what's working against you.

The Off-Plan Trap

Off-plan is where developers show you an empty plot and promise a tower in three years. You pay 20% down, then installments during construction. You're essentially funding their project with your capital.

Agents push off-plan because they earn 5-7% commission on these deals. On secondary market (existing properties), they earn 2%. The math is obvious—they're selling what pays them, not what performs for you.

Real example: A friend bought a three-bedroom in Business Bay for 4 million AED. Current valuation: 2.8 million AED. Bad for him. Good for the agent who cashed their commission years ago.

The Luxury Trap

When you arrive in Dubai, you'll be pitched the most prestigious addresses. Palm Jumeirah. Branded residences. The newest, most luxurious developments.

These properties command premium prices—and generate 3% returns. You're paying for prestige, not performance.

As an investor focused on cash flow and net worth growth, I stay away from anything "luxury." The returns don't justify the capital.

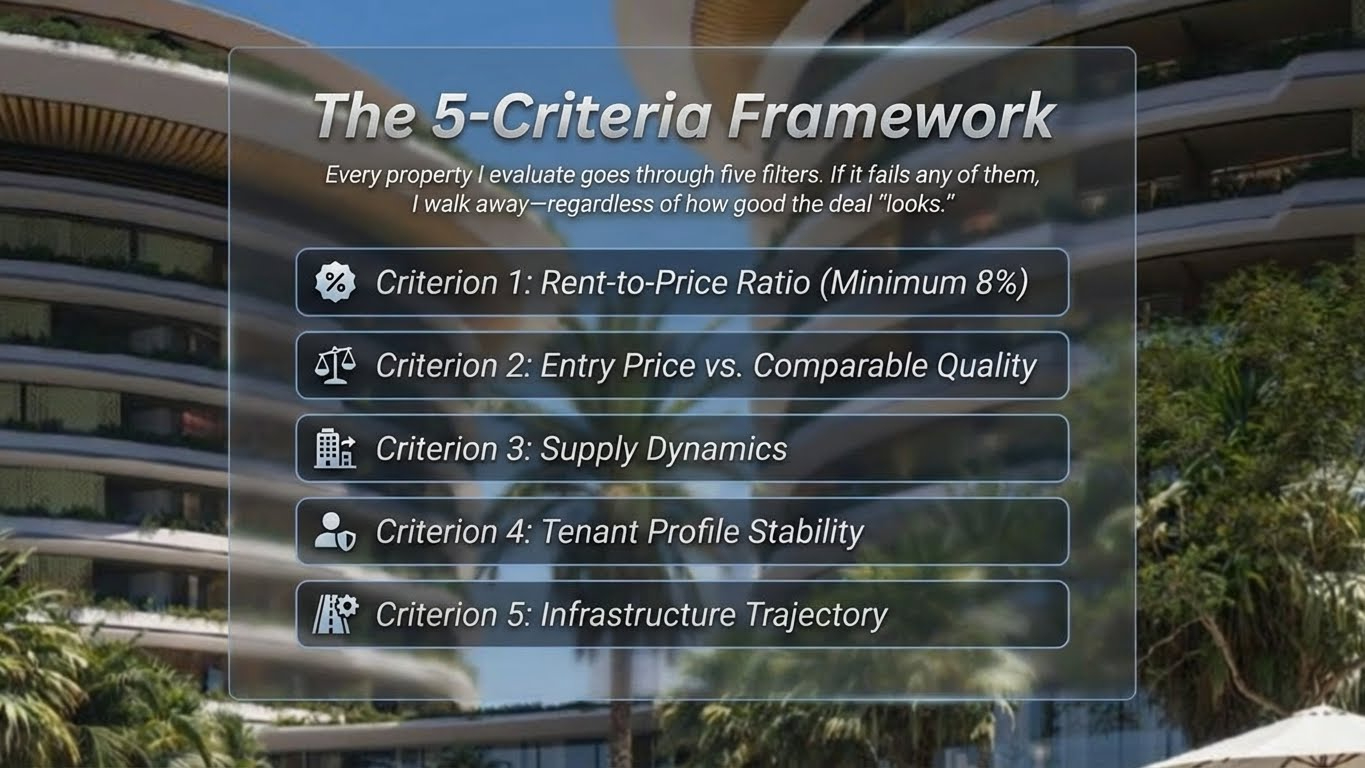

The 5-Criteria Framework

Every property I evaluate goes through five filters. If it fails any of them, I walk away—regardless of how good the deal "looks."

Criterion 1: Rent-to-Price Ratio (Minimum 8%)

This is the foundation. If a property costs 500,000 AED, how much net profit can I generate annually?

My minimum threshold:

8-9% net ROI. Anything below that is not a deal worth pursuing.

How to calculate: Use Property Finder, Bayut, and Dubizzle to research comparable rental rates in the building and area. Cross-reference against purchase prices on DXB Interact, which shows actual transaction history—what units in that building actually sold for, not what they're listed at.

If the math doesn't hit 8% minimum before you account for renovation and operational improvements, move on.

Criterion 2: Entry Price vs. Comparable Quality

This is where most investors lose money. They overpay relative to what they're getting.

Key principle:

Everything inside the apartment can be fixed. Focus on what you can't change.

What you can't change:

Building quality and management

Location within the area

Views

Building reputation

I made this mistake early. Bought an apartment where the building had poor management. The lobby gave visitors bad feelings immediately. That affects tenant quality, rental rates, and resale value—things no renovation can fix.

Evaluate the building, not just the unit. Walk the common areas. Talk to residents if possible. Check Google reviews. A "cheap" unit in a poorly-managed building is expensive in the long run.

Criterion 3: Supply Dynamics

Dubai is expanding constantly. New developments launch every month. This creates a critical question:

Will new supply compete with your property?

I look for:

High demand areas – Where people already want to live

Limited new supply – Areas that are already built out

Established neighborhoods – Not "emerging" areas with "projected" demand

If you buy in an area where developers are still building dozens of towers, you're competing with new inventory for tenants. Your rents get compressed. Your occupancy suffers.

Buy where people are fighting to live—not where they might want to live someday.

Criterion 4: Tenant Profile Stability

Who lives in this building? Who rents in this area? This determines your operational experience.

Some buildings attract stable, long-term professionals. Others attract transient populations with higher turnover and payment risk.

I evaluate:

Proximity to business districts (attracts working professionals)

Building quality and amenities (attracts quality tenants)

Price point relative to area (mid-market often more stable than budget)

Historical occupancy in the building

Property management becomes much easier when you're attracting the right tenant profile from the start.

Criterion 5: Infrastructure Trajectory

What's happening around the property? Is the area improving or declining?

I look for:

Metro access – Ideally within 5 minutes walking

Daily amenities – Supermarket, pharmacy, restaurants within the building or nearby

Commercial activity – Offices, retail, employment centers nearby

Lifestyle amenities – Gym, pool, barber shops in proximity

Both properties I renovated are 5 minutes from metro stations. Both have supermarkets directly downstairs. One is 5 minutes from JBR beach; the other is 15 minutes from Burj Khalifa and Dubai Mall.

These infrastructure factors drive demand—and demand drives returns.

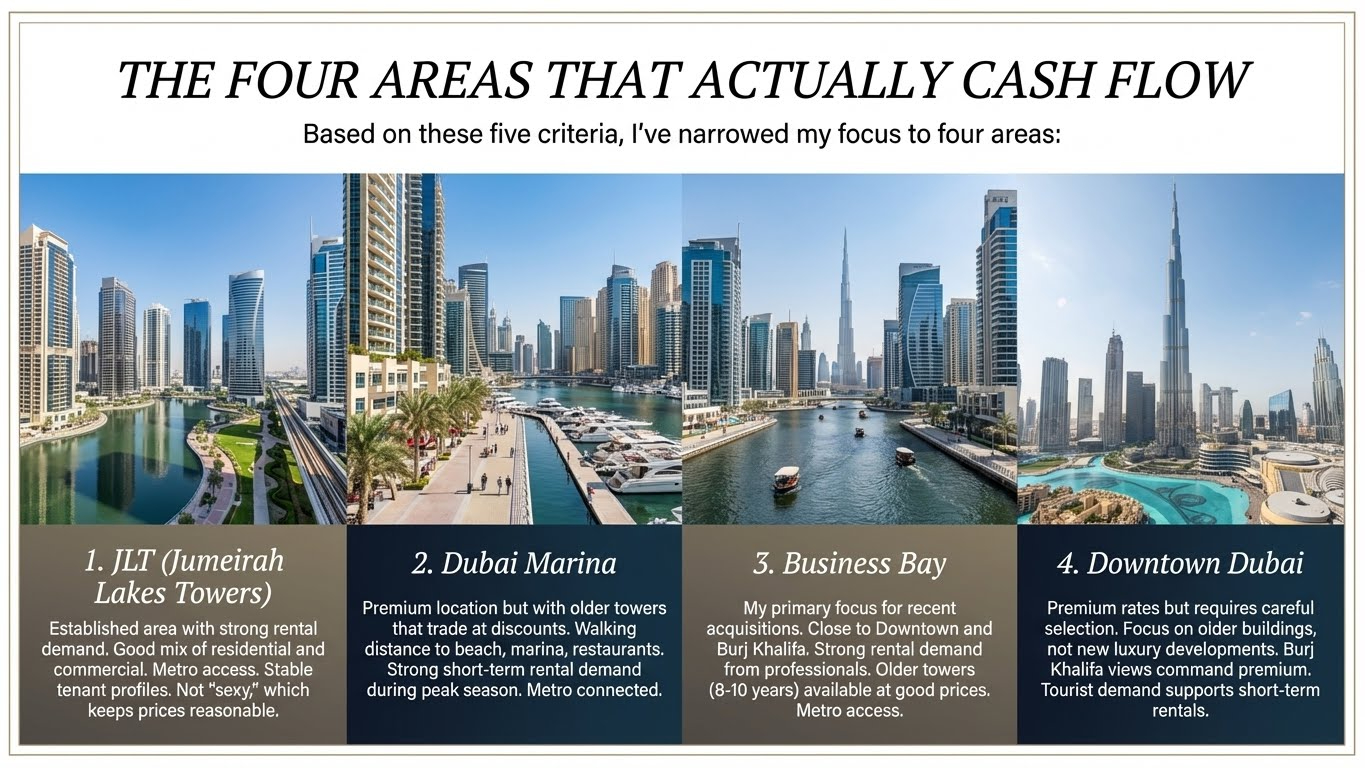

The Four Areas That Actually Cash Flow

Based on these five criteria, I've narrowed my focus to four areas:

1. JLT (Jumeirah Lakes Towers)

Established area with strong rental demand. Good mix of residential and commercial. Metro access. Stable tenant profiles. Not "sexy," which keeps prices reasonable.

2. Dubai Marina

Premium location but with older towers that trade at discounts. Walking distance to beach, marina, restaurants. Strong short-term rental demand during peak season. Metro connected.

3. Business Bay

My primary focus for recent acquisitions. Close to Downtown and Burj Khalifa. Strong rental demand from professionals. Older towers (8-10 years) available at good prices. Metro access.

4. Downtown Dubai

Premium rates but requires careful selection. Focus on older buildings, not new luxury developments. Burj Khalifa views command premium. Tourist demand supports short-term rentals.

What About JVC?

I'll be direct: JVC is not for me. It's frequently pitched as "affordable" with "high yields." But it fails the supply dynamics test—massive ongoing development means constant competition from new inventory. The tenant profile is less stable. Infrastructure is still developing.

Agents love JVC because there's tons of inventory to sell. I avoid it because I want properties that cash flow reliably from day one.

The Older Tower Strategy

Here's the insight that transformed my returns:

buy older towers in prime areas.

Everyone in Dubai chases new and shiny. They want the latest development, the most modern finishes, the newest amenities. This creates a pricing anomaly: perfectly good buildings that are 8-10 years old trade at significant discounts.

These buildings are:

Structurally sound

In established, proven locations

Surrounded by mature infrastructure

Available at 10-15% below market value

The units themselves may need work—dated finishes, worn fixtures, previous tenant damage. Most buyers walk away. That's exactly what I want.

The Renovation Play

I buy these "ugly" units and renovate them to premium standard. Budget: $20,000-$30,000 USD (75,000-110,000 AED).

What I typically do:

Complete bathroom renovation (tiles, fixtures, shower conversion)

Kitchen update or full renovation

All walls repainted

Doors factory-painted white

New flooring where needed

Modern lighting and ceiling work

Quality furnishing throughout

The result: a unit that commands premium rental rates in a building most people overlook. I'm not competing with luxury new-builds on prestige—I'm offering renovated quality at better value in proven locations.

Real Example: Before and After

One of my Dubai Marina acquisitions. The unit was in terrible condition—walls damaged, bathroom ceiling literally falling off, required multiple pest control treatments.

Most investors would have walked away. I bought it 10-15% below comparable units in the same building.

After renovation: complete bathroom rebuild, new tiles throughout, all walls painted, fully furnished to modern standard.

This property now generates strong returns in one of Dubai's most desirable areas—because I bought the worst unit in a great building and transformed it.

I've bought off-plan. I've bought ready apartments in good condition. The best decisions I ever made were buying older towers and renovating them. I'm never going back to any other strategy.

Property Management: The 12% Sweet Spot

Acquisition is half the equation. Property management is where you capture the full return.

My approach:

never long-term rentals. Always a blend of short-term and mid-term.

Why Avoid Long-Term Rentals

Long-term (annual) rentals in Dubai create two problems:

Lower returns. You're locked into annual rates that don't capture seasonal demand spikes.

Tenant risk. Dubai tenant laws make eviction extremely difficult. One bad tenant can cost you months of income and legal headaches.

The Blended Strategy

Dubai is highly seasonal:

Peak season (November–April): Perfect weather. Tourists flood the city. Events, conferences, holidays. Short-term rental rates spike.

Off-peak (May–October): Hot weather. Lower tourist traffic. Demand shifts to mid-term stays—corporate relocations, project professionals, families exploring Dubai.

The strategy:

Short-term rentals (nightly/weekly) during peak season to capture maximum rates

Mid-term rentals (1-6 month contracts) during off-peak for stability

Never annual leases that lock you into below-market rates and tenant risk

This blended approach is how you move from 8-9% returns to the

12-13% sweet spot—net profit, not revenue.

I run my own in-house operation for property management. Most management companies either skim or overcharge. The operational layer is too important to outsource to people who don't share your incentives.

The Framework in Action

My investment philosophy is simple:

never sell.

I can't remember the last time my family sold a property. Maybe once since I was born—and that was to replace with something better.

When you have that mindset, you have to be extremely selective about what you buy. Every acquisition needs to cash flow reliably for decades. Every property needs to pass all five criteria.

The framework ensures I'm not chasing shiny objects or falling for agent pitches. I'm buying assets that generate 8-12% net returns, in proven locations, with renovation upside, and operational flexibility.

That's the game. Everything else is distraction.

[CTA: For serious investors looking to apply this framework in Dubai—book a strategy call / Join the investor network]

Topics

Related Articles

View all

How to Find 10-13% ROI Rental Properties in Dubai: An Investor's Framework

Learn the exact 11-step framework for finding Dubai rental properties yielding 10-13% ROI. From an active investor with 9 properties—not another agent pitch. Dubai rental property ROI, Dubai Airbnb investment, Dubai real estate investment strategy, high-yield Dubai property, Dubai short-term rental returns

8 min read

Why Dubai Long-Term Rentals Are a Trap for Serious Investors (And What Actually Works)

Dubai's tenant protection laws strip landlords of control. Learn why savvy investors are abandoning long-term rentals—and the asset control strategy delivering 10%+ returns instead.

8 min read

The Dubai Safety Net: How High-Net-Worth Investors Build 10%+ Tax-Free Cash Flow

A framework for $10M+ investors to build tax-free, cash-flowing real estate portfolios in Dubai. From an investor with multi-8-figure holdings—not another agent pitch.

9 min read