If you're investing in Dubai — or thinking about it — there's something you need to understand.

There's a scandal happening in plain sight.

It's not hidden. It's not complicated. It's just that no one talks about it because the people who profit from it control the narrative.

I'm going to break it down with actual numbers. Not projections. Not marketing. Real transaction data from Dubai Land Department.

And I'm going to show you what I do instead — as someone who's been investing in real estate for nearly 100 years across my family, and who currently owns and operates multiple properties in Dubai generating 10%+ net returns.

The Marketing Machine You're Up Against

Have you noticed something?

Every agent. Every Instagram ad. Every property exhibition. Every "exclusive launch event."

They all push off-plan.

I cannot remember the last time an agent proactively tried to sell me a ready property. Not once.

Why?

Because the entire marketing budget in Dubai goes to off-plan. Developers spend millions on brochures, renders, launch events, influencer partnerships. They control the conversation.

And when you're outspent, you lose the narrative war.

But numbers don't lie. Let me show you what's actually happening.

The Commission Structure That Explains Everything

Here's the math that nobody wants you to see:

Transaction TypeAgent CommissionOff-plan5-7%Secondary market2%

Let's make this concrete.

On a 2,000,000 AED off-plan sale: Agent earns: 100,000 - 140,000 AED

On a 2,000,000 AED secondary sale: Agent earns: 40,000 AED

The agent makes 3x more selling you off-plan.

But it gets worse.

To sell you off-plan, the agent shows you a pretty brochure. One meeting. Easy close.

To sell you secondary, the agent has to show you 300 properties. Find distress deals. Negotiate with sellers. It's actual work.

Less commission. More effort.

You do the math on what gets pushed.

Every "VIP allocation." Every "limited time pricing." Every "exclusive launch." It exists because off-plan is where the money is — for agents and developers. Not for you.

The Historical Price Gap

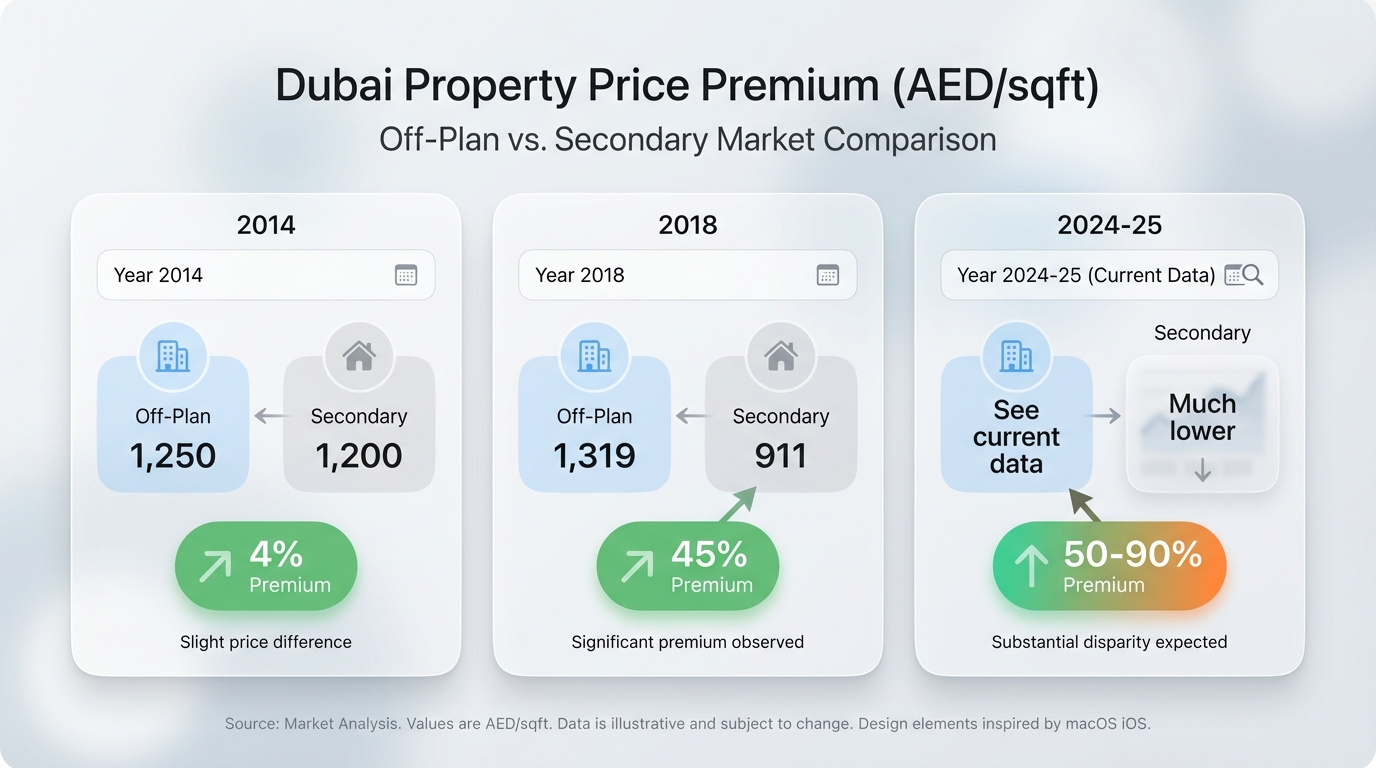

I pulled the data going back to 2014. Here's what average prices per square foot looked like:

The gap has exploded.

And here's what most people miss: these are averages.

I don't buy average. Neither should you.

If the average secondary price is 1,000 AED/sqft, I'm finding deals at 850-900. Distress sellers. Motivated vendors. People who need to close quickly.

Developers don't give discounts. They can't — their margins are built into the price. Land cost. Construction. Marketing. Agent commissions. Profit margin.

You're paying retail with everything baked in.

Secondary market is wholesale. And with the right approach, you can buy 10-15% below even that.

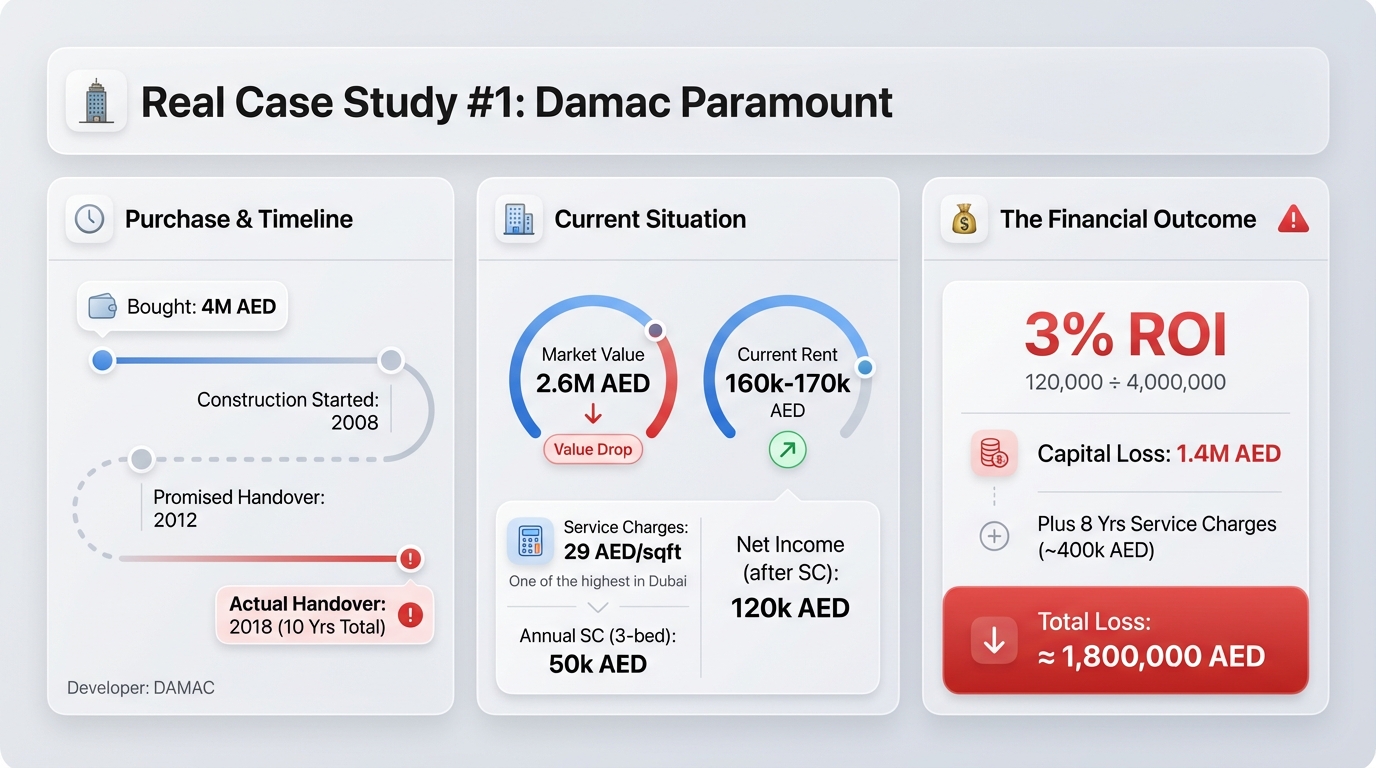

Real Case Study #1: Damac Paramount

I used to rent a three-bedroom in this tower when I first came to Dubai. Let me show you what happened to the owner.

Purchase details:

Bought: 4,000,000 AED

Developer: DAMAC

Construction started: 2008

Promised handover: 2012

Actual handover: 2018 (10 years to complete)

Current situation:

Market value: 2,600,000 AED

Service charges: 29 AED/sqft (one of the highest in Dubai)

Annual service charge (3-bed): 50,000 AED

Current rent: 160,000-170,000 AED

Net income after service charges: 120,000 AED

The math:

120,000 ÷ 4,000,000 = 3% ROI

Capital loss: 1,400,000 AED

Plus 8 years of service charges (~400,000 AED)

Total loss: approximately 1,800,000 AED

The owner is collecting 3% on an asset that's depreciated 35%.

I'm getting 10-11% net on properties that have appreciated.

Same city. Same market. Completely different outcomes based on what you buy and how you buy it.

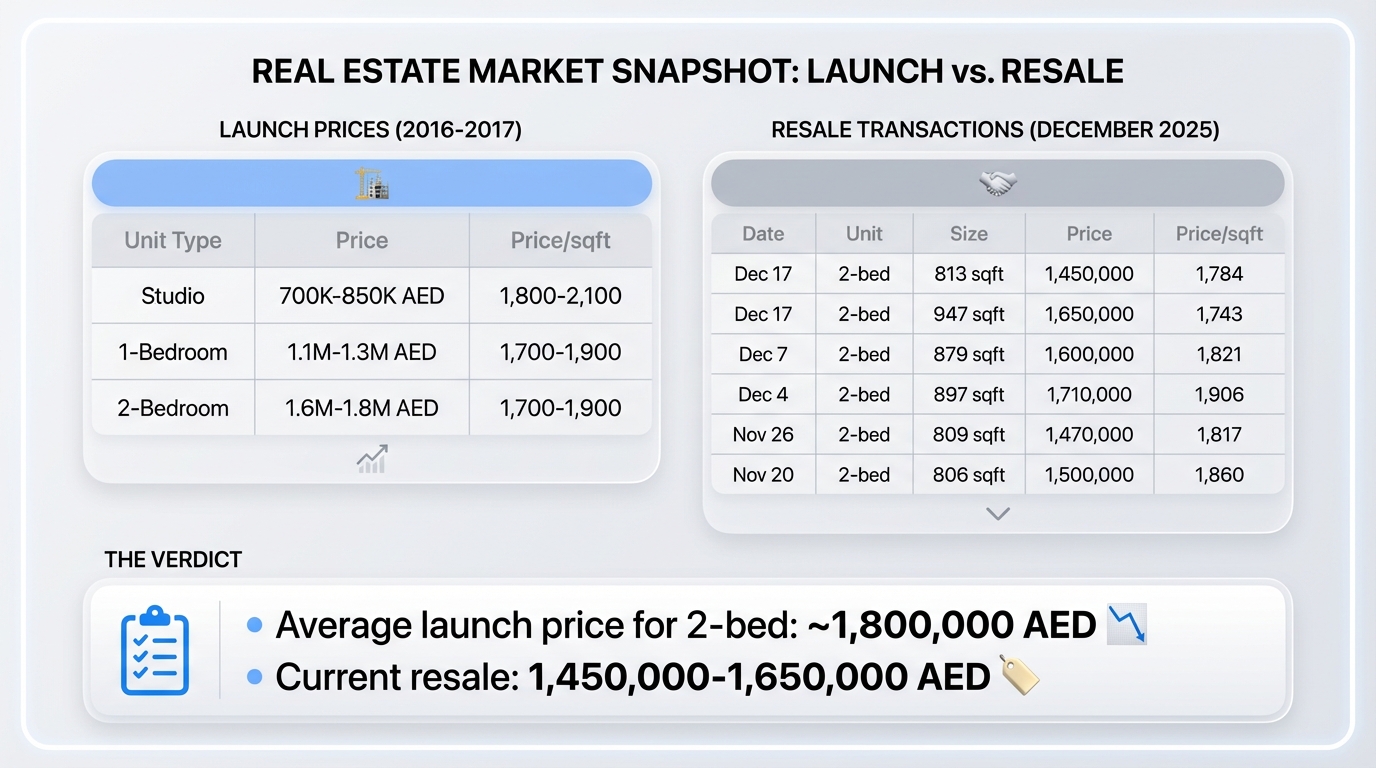

Real Case Study #2: Aykon City Business Bay

This one is particularly relevant because I pulled actual DLD transaction data from December 2025.

That's a 20-27% loss after holding for 8 years.

No rental income for the first 3-4 years (construction + handover delays). Then 4-5 years of collecting rent while watching the asset depreciate.

These aren't edge cases. This is the pattern.

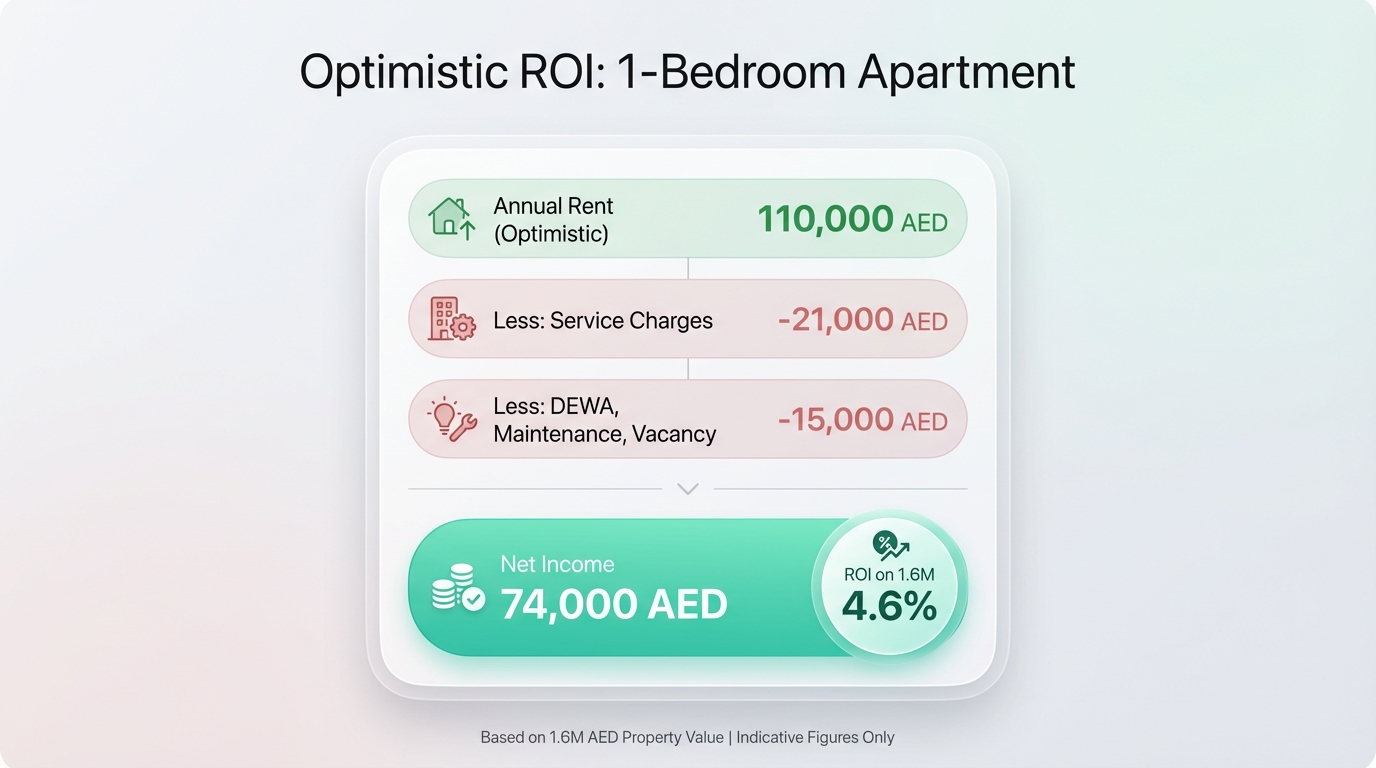

Real Case Study #3: Safa One by de Grisogono (DAMAC)

Let's look at a current off-plan project and calculate what the ROI will actually be — not the marketing projection, but the real math.

Current launch prices:

1-Bedroom: 1,600,000 AED

2-Bedroom: 2,300,000 AED

Price per sqft: 1,850-1,900 AED

What they don't tell you — service charges:

Projected: 22-26 AED/sqft

Let's use average: 24 AED/sqft

For 1-bedroom (~850 sqft): 20,400 AED/year

And that's optimistic. That's assuming:

No vacancy

Optimistic rent projections

No major maintenance

No delays or issues

Reality is usually worse.

4.6% ROI on a depreciating asset.

Meanwhile, I'm getting 10%+ on assets that appreciate.

The Supply Tsunami Coming

Here's what makes the current off-plan situation even more dangerous:

S&P Global estimates:

2025-2026 new supply: 182,000-210,000 units

Historical average: 40,000 units/year

That's 4-5x the normal supply

If you bought off-plan in 2022-2023, you're getting keys when everyone else is getting keys.

You're not "getting in early." You're arriving at the same time as 200,000 other units.

That's a supply shock.

Competition means downward pressure on rents. More inventory means downward pressure on prices.

The off-plan buyers from 2022-2023 are about to face a very difficult market in 2025-2026.

The "Old Building" Lie

Here's an argument I hear constantly from agents pushing off-plan:

"But this is a new building. Old buildings depreciate. You want something modern."

This is complete nonsense.

My family has owned buildings for 60+ years. Commercial buildings. Residential buildings. They don't collapse. They don't disappear.

A building is a building. With proper maintenance, it will stand for 200 years.

The "old building" argument is manufactured to justify the off-plan premium. It has no basis in reality.

What matters is:

Location

Condition (which you control through renovation)

Operating costs (service charges)

Rental demand

A 10-year-old building in Dubai Marina with 15 AED/sqft service charges outperforms a brand new building with 25 AED/sqft service charges every single time.

What Actually Works: The Secondary Market Strategy

Here's exactly what I do — and what generates 10%+ net returns:

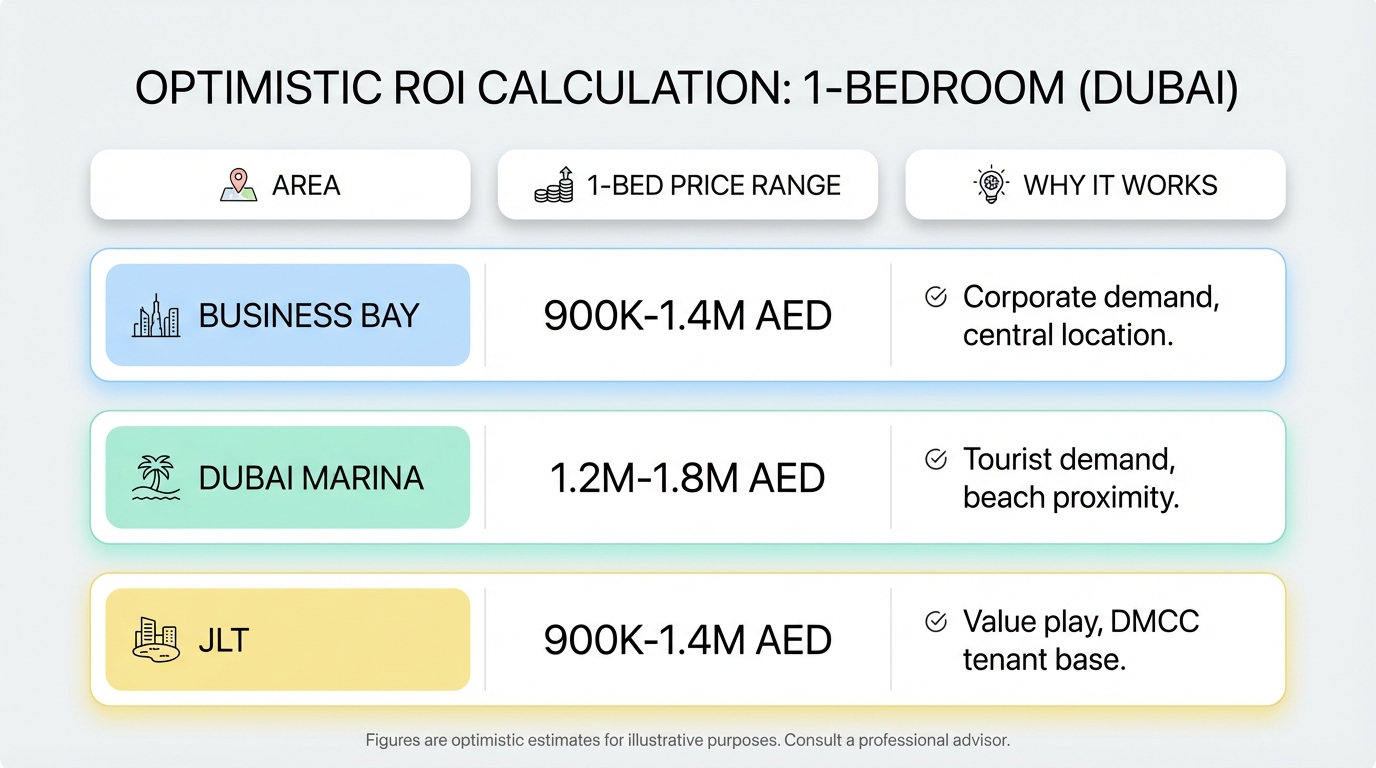

Step 1: Target the Right Areas

Prime locations only. Established demand. Proven rental history.

Step 2: Target Older Towers

My preference: 8-12 years old.

Why? Because Dubai buyers are obsessed with "new." They chase the latest development, the shiniest tower.

This creates pricing inefficiency. Perfectly good buildings in premium locations trade at discounts simply because they're not the newest thing.

As an investor, I want value — not prestige.

Step 3: Buy Below Market

I put 400-500 offers to close one deal.

That's not an exaggeration. I have someone whose job is to identify and submit offers on distressed properties.

Target: 10-15% below comparable sales.

These sellers exist:

Divorce situations

Visa issues requiring quick exit

Financial distress

Investors who need liquidity

Estate sales

Developers don't give discounts. Motivated sellers do.

Step 4: Renovate to Premium Standard

I buy units in poor condition:

Dated finishes

Worn fixtures

Neglected maintenance

These trade at additional discounts — 10-15% below even comparable secondary units.

Then I renovate:

Modern bathrooms

Updated lighting

Quality furnishing

Premium finishes that photograph well

The renovation creates the value. The unit commands premium rates because it's nicer than everything else in the building.

Step 5: Operate Through Short-Term Rentals

I don't do long-term annual leases. I've covered the tenant law problems extensively elsewhere.

Blended strategy:

Short-term rentals during peak season (Dec-Mar)

Mid-term contracts during off-peak (Apr-Nov)

This maximizes yield while maintaining asset control.

Real Results: My Recent Purchase

Let me show you actual numbers from a recent acquisition:

Property:

Location: Business Bay

Unit: 2-bedroom

Purchase price: 1,200,000 AED (below market)

Condition: Needed renovation

After renovation:

Annual rental income: 150,000 AED (short-term rental)

Operating costs: ~50% of gross

Net income: ~75,000 AED

Net ROI: 6.25%

Compare to off-plan 2-bed in same area:

Purchase: 2,200,000+ AED

Expected rent: Similar or lower

ROI: 3-4%

I paid 1.2M for a property generating 150K.

My neighbor paid 2.2M for a property generating less.

Same building type. Same tenant pool. Same neighborhood.

The difference is what we bought and how we bought it.

The Pattern Nobody Discusses

Let me be direct about what's happening in Dubai:

Developers price for profit. Their margins — land, construction, marketing, commissions, profit — are baked into off-plan pricing.

Agents push what pays. 5-7% commission on off-plan vs 2% on secondary means they're financially incentivized to sell you the worse investment.

Marketing controls narrative. The budget disparity between off-plan and secondary marketing is massive. You hear what developers want you to hear.

New investors get exploited. People coming to Dubai don't know the market. They trust agents. They buy based on renders and payment plans.

The pattern repeats. Every cycle, new investors buy off-plan at premiums, hold through depreciation, and eventually sell to secondary buyers at discounts.

The off-plan buyer from 2017 is selling to me at a loss in 2025.

The off-plan buyer from 2022 will sell to someone like me at a loss in 2030.

The game continues.

Who This Strategy Is For

I want to be clear about who should read this and who shouldn't.

This works if:

You're building long-term wealth (not flipping)

You can deploy 1M+ AED meaningfully

You understand that real returns require real work

You're patient enough to find the right deals

You want assets that generate income from day one

This doesn't work if:

You want to flip in 6 months

You're chasing prestige over returns

You expect passive income without operational involvement

You're buying based on brochures and renders

I'm not interested in helping flippers. Flipping is gambling. Some win, most lose.

I'm interested in building assets that generate cash flow for decades. Properties you never sell. Income you can pass to your children.

That's what my family has done for 100 years. That's what works.

The Bottom Line

There's a scandal in Dubai real estate.

It's not illegal. It's just economics working against uninformed investors.

Developers price for profit. Agents sell what pays them. Marketing drowns out reality. New investors get exploited.

The numbers don't lie:

Off-plan premiums: 50-90% over secondary

Off-plan ROI: 3-5%

Off-plan depreciation: 20-35% over holding period

Secondary market with proper execution:

Entry: 10-15% below market

ROI: 8-12% net

Appreciation: positive over holding period

Same city. Same tax environment. Completely different outcomes.

The question is whether you'll be the person buying off-plan at a premium or the person buying secondary at a discount years later.

I know which side I'm on.

For serious investors:

I invest my own capital in Dubai properties. I manage them through short-term rentals. Everything I share comes from personal experience with skin in the game.

If you're looking to build a Dubai portfolio the right way — secondary market, below market, proper operations — I'm happy to discuss specifics.

Investor to investor. Not agent to buyer.

CTA 1 will appear here

Related Articles

View all

How to Find 10-13% ROI Rental Properties in Dubai: An Investor's Framework

Learn the exact 11-step framework for finding Dubai rental properties yielding 10-13% ROI. From an active investor with 9 properties—not another agent pitch. Dubai rental property ROI, Dubai Airbnb investment, Dubai real estate investment strategy, high-yield Dubai property, Dubai short-term rental returns

8 min read

Why Dubai Long-Term Rentals Are a Trap for Serious Investors (And What Actually Works)

Dubai's tenant protection laws strip landlords of control. Learn why savvy investors are abandoning long-term rentals—and the asset control strategy delivering 10%+ returns instead.

8 min read

The Dubai Safety Net: How High-Net-Worth Investors Build 10%+ Tax-Free Cash Flow

A framework for $10M+ investors to build tax-free, cash-flowing real estate portfolios in Dubai. From an investor with multi-8-figure holdings—not another agent pitch.

9 min read